Many sauna purchases at The Sauna Place may be HSA/FSA eligible. We partner with Truemed to provide a simple way to request a Letter of Medical Necessity (LMN) from an independent licensed provider. If an LMN is issued, you can use your pre-tax funds for your purchase. Below, we outline the process.Not all customers or products are eligible. Eligibility requires a licensed clinician to issue a Letter of Medical Necessity (LMN).

3 Steps to Request HSA/FSA Eligibility

Step 1 — Check Out

Find the Truemed logo at checkout and start the process.

Step 2 — Complete Health Assessment

Take a quick, private health survey via Truemed. An independent licensed provider—not The Sauna Place—will review your information to decide if an LMN is appropriate.

Step 3 — Make Your Purchase

If an LMN is issued, you can pay with your HSA/FSA card or a regular card and seek reimbursement later, subject to your plan's rules.

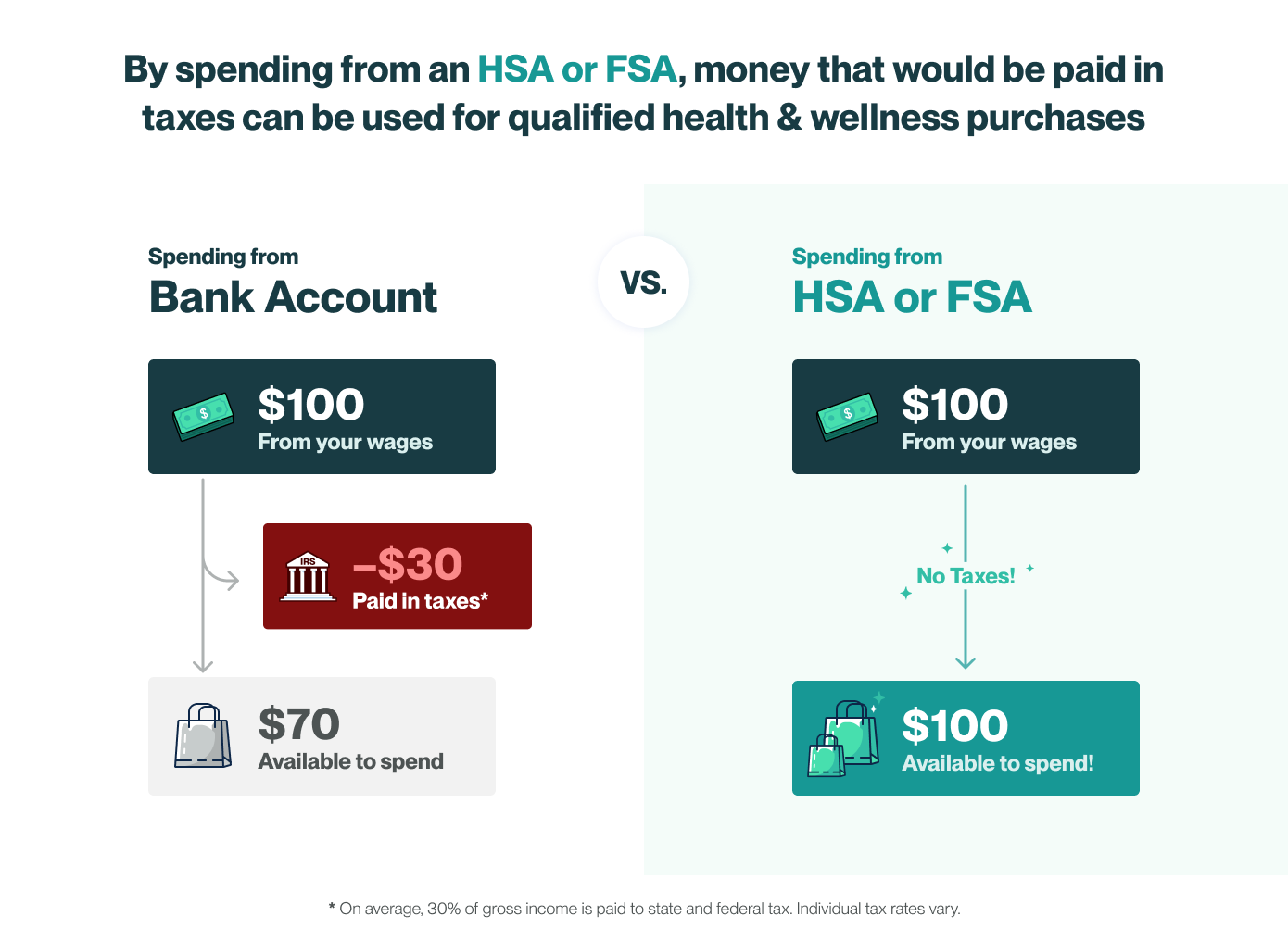

How HSA/FSA Funds Can Potentially Save You Money

Using pre-tax HSA/FSA funds may increase your purchasing power compared to post-tax spending. Savings are not guaranteed. Consult your tax advisor.Savings come from pre-tax spending and are not discounts.

Who is Truemed?

At Truemed, we believe in investing in health rather than waiting to spend on sickness. By connecting consumers to licensed providers who can substantiate the need for certain wellness products, Truemed helps shift healthcare spending toward true preventive medicine. Truemed does not determine eligibility or make products eligible.

Example Products That May Be Eligible (with an LMN)

Frequently Asked Questions

Who decides if I qualify for an LMN?

An independent licensed provider reviews your health questionnaire through Truemed's portal and decides whether to issue a Letter of Medical Necessity (LMN). The Sauna Place does not make medical determinations.

Do you see my private health information?

No. Your medical questionnaire is confidential and handled by the provider via Truemed. We only receive your order and payment details, not your medical answers.

What happens if my LMN request is not approved?

You can still complete your purchase normally using our standard payment options. Our standard return policy applies to your order.

What are FSA and HSA accounts?

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are tax-advantaged accounts that allow you to set aside pre-tax dollars for qualified medical expenses. We recommend checking with your employer or insurance provider to learn more about your plan.

What is a Letter of Medical Necessity (LMN)?

A Letter of Medical Necessity (LMN) is a document from a licensed provider that substantiates a medical need for a product. When an LMN is issued for a wellness product like a sauna, it can make that purchase a qualified medical expense under IRS guidelines. Truemed's process is designed to ensure the LMN you receive, if you qualify, meets these requirements.

Can I use my HSA/FSA at The Sauna Place?

Many of our products may be eligible for purchase with an HSA/FSA card if you are issued a Letter of Medical Necessity (LMN). At checkout, you can request an LMN from an independent licensed provider through Truemed’s portal.

Can I use my regular credit card at checkout?

Yes. If you are issued an LMN, you can choose to pay with a regular card in the Truemed checkout. After your purchase, Truemed will email you instructions to submit the receipt to your HSA/FSA administrator for reimbursement, subject to your plan's rules.

When should I use my FSA/HSA dollars?

You can use HSA/FSA funds throughout the year. It's important to note that FSA funds often have a "use-it-or-lose-it" rule and may expire at the end of your plan year (commonly December 31). HSA funds typically roll over. Please check your specific plan details with your administrator.

How long does it take to receive an LMN?

If your request is approved, an LMN is typically issued in 2–5 hours. Some cases may require more time for provider review. Approval is not guaranteed. If you don’t see your letter, check your spam folder, then contact support@truemed.com.

I don’t have an HSA/FSA. Can I use this service?

Truemed’s service is specifically for individuals who have an active HSA or FSA. If you're interested in these accounts, we recommend speaking with your employer about your plan options, especially during open enrollment.

Is this available outside the US?

Currently, Truemed’s services are available only to customers in the United States.

Important Disclosures

- Independent Medical Review: All requests for a Letter of Medical Necessity (LMN) are evaluated by independent licensed medical providers through the Truemed platform. The Sauna Place has no role in the medical determination and does not guarantee an LMN will be issued.

- Privacy: Your personal health information is submitted directly to the provider via Truemed's secure portal. The Sauna Place does not see, handle, or store your medical answers or records.

- No Guarantee of Savings: Eligibility for HSA/FSA spending requires an LMN. Reimbursement is subject to your individual plan's rules and limitations.

- Tax Advice: The use of HSA/FSA funds can have tax implications. This information is not tax advice. Please consult your plan administrator or a qualified tax professional.

Technical Appendix: Using HSA/FSA With Truemed

We keep the process straightforward: confirm eligibility, choose a payment path, and keep records. The summary below extends the FAQ above with the practical steps and numbers we walk through with customers every day.

1) Process at a Glance (What We Recommend)

- Add your items to cart.

- Check out as a guest (be sure you’re not signed into Shop Pay).

- Select Truemed as the payment option.

- If an LMN is issued, pay with your HSA/FSA card or use a regular card and follow Truemed’s reimbursement instructions later.

2) Savings Mechanics in Plain Terms

HSA/FSA accounts use pre-tax dollars for eligible expenses tied to a diagnosed condition. Paying pre-tax may increase purchasing power compared with spending post-tax income. Contribution references are summarized here:

| Account | Individual | Family | Catch-up (55+) | Employer Add-On |

|---|---|---|---|---|

| HSA | $4,150 | $8,300 | +$1,000 | — |

| FSA | $3,200 | Plan-dependent | — | Up to +$500 employer contribution |

3) Effective Cost Examples (Illustrative Only)

Pre-tax payment can reduce effective out-of-pocket cost roughly by your marginal tax rate. Examples below show the concept:

| Cart Total | 22% (example) | 30% (example) | 37% (example) |

|---|---|---|---|

| $500 | $390.00 | $350.00 | $315.00 |

| $1,000 | $780.00 | $700.00 | $630.00 |

| $5,000 | $3,900.00 | $3,500.00 | $3,150.00 |

These figures are for illustrative purposes only and assume a user has received a Letter of Medical Necessity. Actual savings depend on your individual tax situation and are not guaranteed. Please consult your tax adviser.

4) Payment Workflows (Pick One)

| Path | When We Recommend It | What You Need | Advantages | Considerations |

|---|---|---|---|---|

| Pay in full with HSA/FSA card | If balance is available on the card | Active HSA/FSA card + LMN | Cleanest flow; no reimbursement filing | Card balance/limits; ensure online authorization |

| Pay with regular card, reimburse later | If card is not available or restricted | Receipt + LMN; submit per plan rules | Use any card; keep points/cashback | Follow filing deadlines precisely |

| Split pay (HSA/FSA + another card) | If order exceeds current HSA/FSA balance | HSA/FSA card + a second card | Partial pre-tax benefit without waiting | Both authorizations must succeed |